Is Earnest a Good Student Loan Company: A Comprehensive Overview

Introduction

Student loans play a significant role in enabling millions of individuals to access higher education. However, the decision to borrow—and more importantly, who to borrow from—is not one to take lightly. As tuition costs rise and interest rates fluctuate, the need for reliable, flexible, and transparent student loan companies becomes more critical than ever.

One of the companies that has garnered attention in recent years is Earnest. Known for its customizable loan options and borrower-friendly policies, Earnest has built a reputation as a modern alternative to traditional lenders. But how good is Earnest really, and is it the right choice for you?

This comprehensive overview explores Earnest’s history, loan offerings, features, benefits, drawbacks, and suitability for different types of borrowers. By the end of this article, you’ll have a clear understanding of whether Earnest is a good student loan company for your unique needs.

1. Company Background

Founded in 2013 and based in San Francisco, Earnest entered the financial scene with the goal of making lending more personal, data-driven, and transparent. In 2017, it was acquired by Navient, a well-established player in the student loan servicing industry. Despite this acquisition, Earnest operates independently and continues to push innovations in lending through its proprietary technology and borrower-first philosophy.

2. Loan Products Offered by Earnest

Earnest provides a suite of loan products primarily centered around higher education. These include:

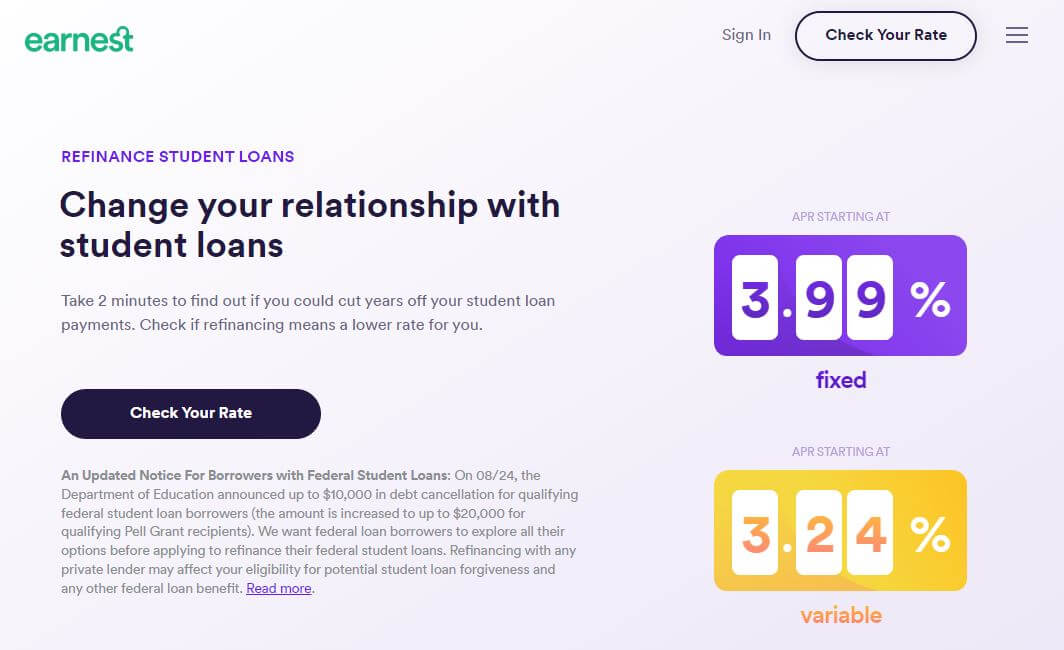

● Student Loan Refinancing

Earnest allows graduates to refinance their existing student loans—whether federal or private—into a single new loan with improved terms. This is particularly helpful for borrowers with high-interest debt who are looking to reduce their monthly payments or pay off their loans faster.

● Private Student Loans

Earnest offers loans for current students to help cover the cost of tuition, books, housing, and other education-related expenses. These loans can be applied for independently or with a co-signer.

● Parent Loans

Parents who want to help fund their child’s education can also apply for loans under Earnest’s private lending program.

3. Notable Features of Earnest

Earnest stands out from traditional lenders due to its technology-driven platform and borrower-centric policies. Some of its most praised features include:

● Precision Pricing

Borrowers can choose their exact monthly payment and loan term down to the month, rather than being locked into standard 5, 10, or 15-year terms. This allows for highly personalized budgeting.

● No Fees

Earnest charges no origination fees, prepayment penalties, or hidden service fees. This can save borrowers a substantial amount over the life of their loan.

● Skip a Payment

Once every 12 months, eligible borrowers can skip one payment with no penalty, offering relief during tight financial situations.

● Rate Match Guarantee

Earnest will match a competitor’s lower interest rate under certain conditions, ensuring borrowers receive the best possible deal.

● In-House Servicing

Unlike some lenders who sell your loan to another company, Earnest services its own loans, meaning a more consistent and accountable customer experience.

4. Pros of Using Earnest

-

Competitive Interest Rates: Earnest offers both fixed and variable interest rates that are often lower than other lenders for qualified borrowers.

-

Highly Customizable Terms: Borrowers can choose repayment terms from 5 to 20 years for refinancing, allowing for better alignment with personal financial goals.

-

User-Friendly Interface: The application process is streamlined, and the dashboard is intuitive, making loan management simple.

-

Soft Credit Check for Prequalification: You can check your rates without affecting your credit score.

-

Strong Reputation for Customer Service: Borrowers often report positive experiences when dealing with Earnest’s support team.

5. Cons and Limitations

While Earnest offers many advantages, there are some limitations worth noting:

-

No Co-Signer for Refinancing: Refinancing applicants must qualify on their own creditworthiness; there’s no option to apply with a co-signer.

-

Not Available in All States: Some loan products may not be offered in every U.S. state, so eligibility varies.

-

Strict Credit Requirements: Earnest is best suited for borrowers with good to excellent credit (typically 650+ credit score).

-

Limited Deferment/Forbearance Options: Compared to federal loans, Earnest’s hardship programs are more limited in scope.

-

Federal Benefits Are Lost When Refinancing: Borrowers refinancing federal loans with Earnest will forfeit access to federal programs such as income-driven repayment or Public Service Loan Forgiveness (PSLF).

6. How to Apply

The application process with Earnest is designed to be fast and user-friendly. Here’s how it typically works:

-

Check Your Rate – Use the online tool to get a rate estimate without affecting your credit.

-

Submit an Application – Complete the full application with personal, financial, and academic details.

-

Review Loan Terms – Choose your repayment period and monthly amount using Precision Pricing.

-

Sign the Agreement – Accept the offer and e-sign your documents.

-

Loan Disbursement – Funds are either used to pay off previous loans (for refinancing) or sent to your school (for in-school loans).

The entire process can often be completed in a matter of days if all documents are in order.

7. Who Should Consider Earnest?

Earnest is best suited for:

-

College Graduates with Stable Income and Strong Credit – Especially those looking to refinance.

-

Students Needing Private Loans – Who want flexible terms and transparent pricing.

-

Borrowers Who Value Customization – Precision Pricing is ideal for those who want more control over their monthly payments.

-

Tech-Savvy Individuals – Who are comfortable applying for and managing loans online.

Earnest may not be ideal for:

-

Those Needing a Co-Signer to Qualify – Particularly for refinancing.

-

Borrowers Seeking Federal Benefits – Such as forgiveness programs or income-driven repayment.

-

Students in States Where Earnest Loans Are Not Available

8. Comparison with Other Lenders

| Feature/Company | Earnest | SoFi | CommonBond | LendKey |

|---|---|---|---|---|

| Co-Signer for Refi | No | Yes | Yes | Yes |

| Custom Loan Terms | Yes | No | No | Varies |

| No Fees | Yes | Yes | Yes | Varies |

| Rate Match Guarantee | Yes | No | No | No |

| Skip a Payment | Yes | No | No | No |

| Credit Requirement | 650+ | 650+ | 660+ | Varies |

9. Final Verdict

Is Earnest a good student loan company? The answer is a resounding yes—for the right borrower.

Earnest offers competitive rates, highly customizable repayment terms, and modern tools that simplify the borrowing experience. Their commitment to transparency and borrower flexibility make them one of the strongest options in the private loan and refinancing market.

That said, borrowers who need more robust hardship support, co-signer options, or federal benefits may want to look elsewhere or use Earnest as part of a larger strategy.

Overall, Earnest is a standout company for responsible borrowers who value control, clarity, and convenience in managing their student loans.